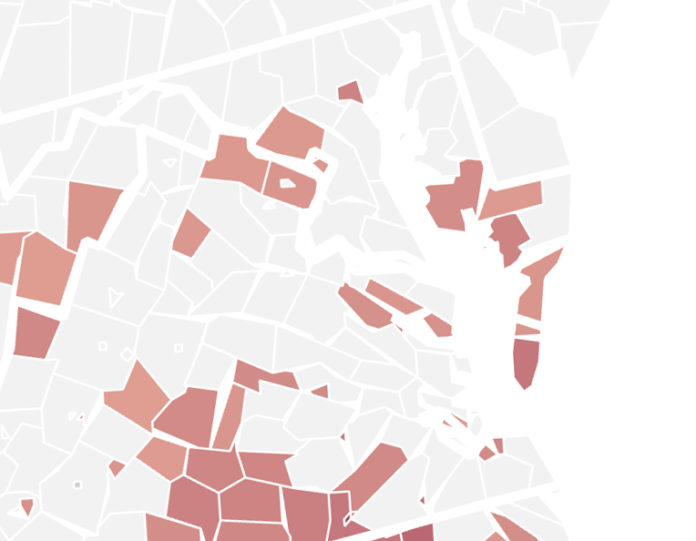

By Linda Cicoira —Northampton County folks have a better than average chance of getting audited by the IRS, according to projects.propublica.org where a map of the U.S. was lit with red marks on the counties that earned the warning.

Approximately 8.6 audits were made for every 1,000 filings in Northampton County between 2012 and 2015. The website stated that the national average was 7.7.

Accomack County also earned the red mark but came in below the national average with an estimated 7.3 audits per 1,000.

“The rates were estimated using audit coverage rates published in the annual IRS Data Book in combination with county tax return data on the IRS website,” the site stated.

A comparison was made between the poor rural Humphreys County, Miss., and affluent Loudoun County, Va.

“In a baffling twist of logic, the intense IRS focus on Humphreys County is actually because so many of its taxpayers are poor,” the site stated. “More than half of the county’s taxpayers claim the earned income tax credit (EITC), a program designed to help boost low-income workers out of poverty … the IRS audits EITC recipients at higher rates than all but the richest Americans, a response to pressure from congressional Republicans to root out incorrect payments of the credit.”

The median annual household income in Humphries is $26,000. In Loudoun, it is $130,000, the highest in the U.S. It is about $37,000 in Northampton and $38,500 in Accomack.

“In counties with the highest audit rates, there were about 11 audits per 1,000 tax returns filed each year,” said the author of the study, Kim M. Bloomquist, a former senior economist with the IRS’ research division. “The map reveals wide variations in the audit rate from place to place, but also how certain groups of Americans are disproportionately affected by the IRS’ policies.”

“The five counties with the highest audit rates are all predominantly African-American, and rural counties in the Deep South,” he said. “The audit rate is also very high in South Texas’ largely Hispanic counties and in counties with Native American reservations, such as in South Dakota. Primarily poor, white counties, such as those in eastern Kentucky, in Appalachia, also have elevated audit rates.”

“The states with the lowest audit rates tend to be home to middle income, largely white populations,” Bloomquist stated. He listed New Hampshire, Wisconsin, and Minnesota. “Generally, the IRS audits taxpayers with household income between $50,000 and $100,000 the least.”